Pay Yourself As a Business Owner in Australia

Table of Contents

When it comes to determining how much to pay yourself as a business owner in Australia, there are a range of financial factors to take into account.

According to data from the Australian Small Business and Family Enterprise Ombudsman, there are more than 2.5 million businesses in operation across Australia.

Of these, a whopping 97% are classified as a small business—those employing fewer than 20 employees—which form the backbone of Australia’s business economy.

But while plenty of hard-working Aussies have made the decision to work for themselves, one of the most common questions many business owners face is what kind of salary to pay themselves.

After all, if you’ve made the decision to run your own company, it seems pertinent to ask: how much should you pay yourself as a business owner in Australia?

Understanding the Stages of Your Business

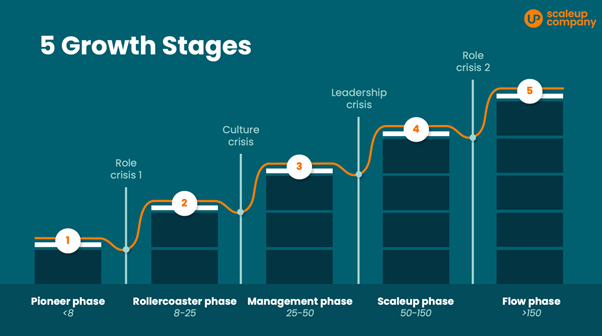

When it comes to deciding how much to pay yourself as a business owner, it helps to start by analysing what sort of growth stage your business is in.

As a general rule, most businesses go through three major stages of growth. They begin in the start-up phase, work through a scale-up period, and ultimately mature into a profitable company.

Before deciding how much to pay yourself as a business owner, the first question you need to ask yourself is: which phase of growth is my business in?

The Start-Up Phase

We’ve all heard the stat. According to the Australian Bureau of Statistics, around 60% of Australian small businesses fail within the first three years of operation.

There are a number of reasons for that—from a lack of need for the product, to underestimating the amount of competition in the marketplace, to a seemingly ever-rising tide of costs.

And with most new business owners more concerned with trying to establish their brand than paying themselves a salary, it’s only natural to wonder just exactly how much you should be paying yourself when first starting out.

For many start-up business owners, that figure is often zero for the first year or two of trade.

After all, if you’ve invested your own capital in founding a company, it stands to reason you’ll also choose to invest every last cent into the business.

But while it may seem logical to pay yourself nothing in salary as the owner of a start-up business, that’s not a sustainable strategy for more than a year or two. After all, even business owners have their own bills to pay!

What most business owners focus on is generating revenue quickly—preferably enough to cover the business’ costs—and ultimately scaling up their salary as soon as finances permit.

If your business is still in the start-up phase, determining a viable minimum salary you can pay yourself every month—and re-investing any surplus funds back into the business—is a simple but effective way to set an objective and remind yourself to strive for that target.

That minimum salary should be a consistent amount you can regularly withdraw without negatively impacting the day-to-day running of your business.

If, however, your costs routinely exceed the money coming in—with no end in sight—then it’s time to talk to an expert about how much your business is really costing you in the long run.

Need to talk to an expert? *******@***************om.au“>Drop us a line or give us a call on 02 9415 1511 for a chat.

The Scale-Up Phase

You’ve founded your business, successfully negotiated the start-up phrase, and your sales have led to a steady—and reliable—cash flow.

It’s time to give yourself a considerable raise, right?

Not quite.

If you’ve successfully navigated the start-up world’s notoriously choppy waters, it can be tempting to believe it’s all smooth sailing from here.

But while it’s gratifying to see your business metrics trending upwards, the scale-up phase can also be a time when many founders and business owners miscalculate their growth.

Added costs like hiring staff, upgrading equipment, or renting office space can quickly add to your business costs and cut into your margins.

There’s also the danger of miscalculating your working capital cycle and failing to convert sales into usable cash.

Make a wrong move here—such as by paying yourself a salary your business can simply not afford—and you could quickly scupper any plans for long-term sustainability.

The key here is to simply be aware of your cash flow—what sort of money is coming and going out of the business—and the impact that paying yourself a higher salary will have on your overall profitability.

Take a measured approach to upgrading your salary in the start-up phase to ensure your business can withstand any headwinds.

The Mature Phase

Congratulations! You’ve done the hard yards, survived the first couple of growth phases, and your business is now undeniably profitable.

Is it time to reward yourself with a salary commensurate with all your hard work? Absolutely.

Although average salaries for small business owners differ across industries and geographical locations, typically founders of a successful company can expect to pay themselves anywhere between $100,000 and $250,000 a year.

And while you may need to adjust your salary over time in line with the prevailing trading conditions, a six-figure salary should be considered just reward for all your hard work.

After all, if you’ve started the business to be your own boss, now is the time to enjoy the fruits of your labour—particularly if you’ve experienced solid year-on-year growth and can now rely upon a steady and consistent stream of income.

How Much Can I Really Afford to Pay Myself?

While it’s important to understand which stage of maturity your business is in before deciding on how much to pay yourself, the truth is salary ranges will always be a subjective matter and keeping your business afloat

Factors like where you are located, which industry you operate in, and even the current state of the economy can all play a role in determining how much salary you pay yourself as a business owner.

And while it may be tempting to simply undertake a quick Google search and base your salary on the average for your industry, it’s much more important to base your salary range on how your business is performing—not your competition.

At the end of the day, the question of how much salary to pay yourself as a business owner is a largely subjective one.

It helps to talk to an expert to gauge exactly where your business is at, so send us an email or give us a call on 02 9415 1511 to discuss how much salary you should pay yourself.