Are Christmas parties tax deductible? Let’s find out

Are Christmas parties tax deductible? It’s a question we hear every year

For firms like PrimeAdvisory, it’s not so much a case of being asked, ‘what are you doing for the holidays?’ or ‘what have the kids asked for this Christmas?’, but more answering questions around Fringe Benefits Tax (FBT) and when the minor benefit threshold kicks in.

But fear not. There are a few simple rules you can follow to make sure you end up on the right side of the ledger when it comes to spreading some Christmas cheer.

Here are our Top 5 Tips on how to throw a (relatively) tax-free Christmas party!

1. Giving a gift? Try not to spend more than $300

Hey big spender… don’t go to tender.

Being generous is one thing, but make sure any gifts you hand out at work don’t cost more than $300. Anything over that amount will incur Fringe Benefit Tax at the rate of 47%.

Make sure it’s a one-off gift and not a recurring benefit, either—such as an annual gym membership or a monthly wine subscription. And remember that gifts of cash will always attract PAYG withholding, as well as being subject to the superannuation guarantee.

So stick to a spontaneous one-off gift and make sure it’s under the $300 minor benefit threshold.

2. Throwing a party? It’s worth holding it in the office

Nothing screams ‘party time’ quite like holding your end-of-year Christmas shindig in the office on a weekday.

But as the highly-experienced team of accountants we are, it would be remiss of us not to point out that office parties held on a weekday on the business premises are exempt from FBT—irrespective of how much you spend per person.

So too are employee taxi rides that start or end at your place of business.

And just remember, if you do end up holding your Christmas party at an offsite location—and you keep the costs below $300 per person to avoid paying FBT—you won’t be able to claim deductions or GST credits for the expenses.

It gets even more complicated if you hold your Christmas party offsite and the value of any gifts you provide, plus taxi fares, and the party itself come in at less than $300 per person—essentially making it FBT-free.

You’ll need to factor in a range of considerations for minor benefits exemption to be applicable, including if and when entertainment is provided.

If it all sounds too complex, just give us a call. We can help talk you through it.

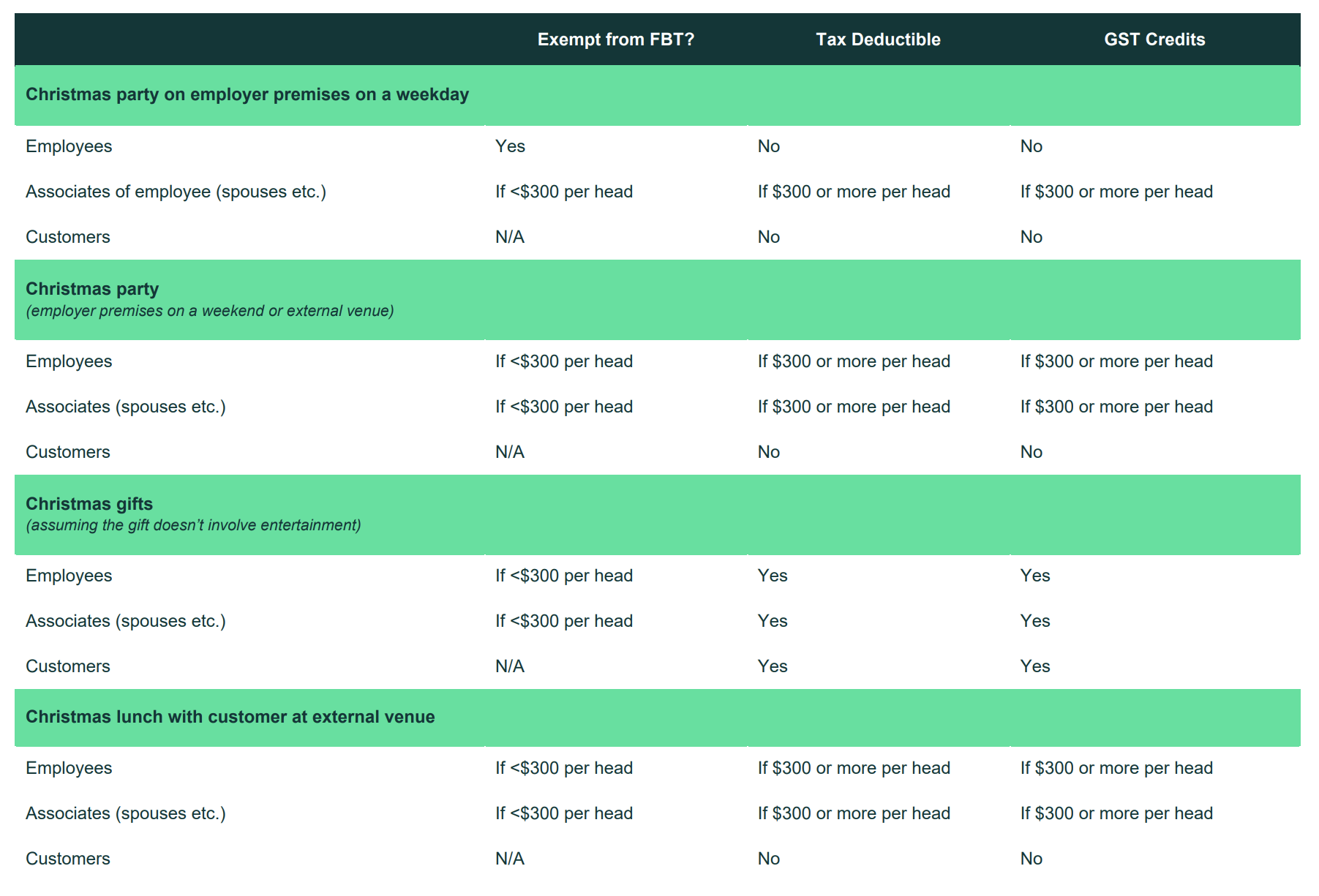

Here’s a quick Christmas tax table to help guide your festivities.

This information is for GST-registered businesses that are not using the 50-50 split method for meal entertainment.

3. Long lunch? A gift has far more tax benefits

A long Friday lunch with clients might be an old Aussie tradition, but it’s not exactly one that provides any kind of tax benefit.

That’s because if you take your client out for lunch—or a day out at the cricket—it’s not tax deductible in any way, and you can’t claim back the GST.

The ATO is particularly strict on expense claims relating to entertainment and will rule against any attempt to claim them, regardless of whether the business views it as a legitimate attempt to generate sales or bolster business relationships.

Gifts, however, are tax deductible—as long as there’s a reasonable expectation the business will benefit from giving it. They’re also a great way to put your business at the forefront of your clients’ minds.

4. Christmas bonuses? Don’t forget the tax implications

While the envelope stuffed with cash from a close relative is a timeless Christmas tradition, the ATO takes a less charitable view of any attempts for employers to help out with a bundle of bills.

Any plans to hand out cash bonuses, rather than actual gifts or even gift vouchers, should theoretically be taxed the same way as salary or wages. That means there’ll be a PAYG withholding amount triggered, and the ATO will treat the bonus as ordinary time earnings—with superannuation guarantee attached.

So it pays to think twice about slipping those crisp $50 notes into that stack of Christmas cards.

5. Still want to give away cash? Why not make it a charitable donation?

When it comes to doing some good this Christmas, why not consider making a donation to your favourite charity of choice?

Not only does it help the charity—which doesn’t have to spend its own hard-earned budget on things like marketing and hosting events—but it’s also fully tax deductible.

Of course, the charity itself must be a Deductible Gift Recipient (DGT). If you need to check whether your charity of choice is a DGR, you can do so on the Australian Business Register.

Purchasing merchandise from a charity doesn’t count, as this is simply treated as money exchanged for goods and services, rather than a tax deductible donation.

Helping to pay for a child’s education or buying a goat in a village overseas is more of a grey area, in the sense that what you’re generally doing is actually donating an amount equivalent to those causes, rather than funding them directly.

Any charitable donation over $2 is tax deductible, so make sure your name is on the receipt so you can claim it at tax time.

And if you have any concerns about any element of your gift-giving at this festive time of the year, please don’t hesitate to drop us a line at [email protected], or call us on +61 (02) 9415 1511.

We’re always here to make more possible.