$3 Million Super Tax Draft Legislation Revealed: What It All Means

It’s the news that Australians with sizeable superannuation balances didn’t want to hear…

The Federal Government is pressing on with its plans to introduce a $3 million ‘super tax’.

Details of the proposed tax hike were first revealed by Treasury in February, which we outlined following the announcement.

In short, earnings on individual super balances of $3 million-plus are set to be taxed at a rate of 30%—double the current impost of 15%.

Earlier this month, the government released exposure draft legislation relating to two bills, which target those with Total Superannuation Balances (TSBs) in excess of $3 million.

The proposal is pushing to implement the changes on July 1, 2025 and to be applicable within the 2025-26 financial year onwards.

As revealed in the wake of Treasury’s announcement in February, the changes are expected to impact roughly 80,000 Australians.

The draft legislation—released on October 3—relates to:

- The Treasury Laws Amendment (Better Targeted Superannuation Concessions) Bill 2023 (the Bill)

- The Superannuation (Better Targeted Superannuation Concessions) Imposition Bill 2023 (the Imposition Bill).

The Bill proposes to insert a new Division 296 in the 1997 Tax Act that, along with the Imposition Bill, will impose a tax at the rate of 15% for super earnings corresponding to the individual’s TSB that surpass $3 million across an income year. This is referred to as the ‘Division 296 tax’.

As detailed in the exposure draft explanatory materials, ‘From the 2025-26 income year onwards, the headline concessional tax rates applying to superannuation earnings are:

- Up to 15% on earnings on superannuation balances below $3 million; and

- Up to an overall 30% on a percentage of earnings equal to the percentage of superannuation balances above $3 million.’

The explanatory notes also state that, ‘The tax is imposed directly on the individual and is separate from the tax arrangements of the superannuation fund or scheme’.

What else would this proposed reform mean for those impacted? Let’s find out…

How Will the Additional Tax Be Calculated?

In official documents, Treasury declared that Australians with super balances above $3 million ‘would be subject to an additional tax of 15% on the earnings on any balance that exceeds the $3 million threshold’.

‘This change broadly brings the headline tax rate on earnings corresponding to that proportion of the balance greater than $3 million to 30%.’

Therefore, earnings relating to funds up to $3 million would continue to be taxed at the 15% concessional rate or less.

Additionally, earnings are determined with reference to the difference in TSB at the beginning and end of a financial year, adjusting for withdrawals and contributions.

There is capacity for negative earnings to be carried forward and offset against the tax in future years’ tax liabilities.

It’s also worth noting that this levy will be separate to an individual’s personal income tax, similar to the existing Division 293 tax.

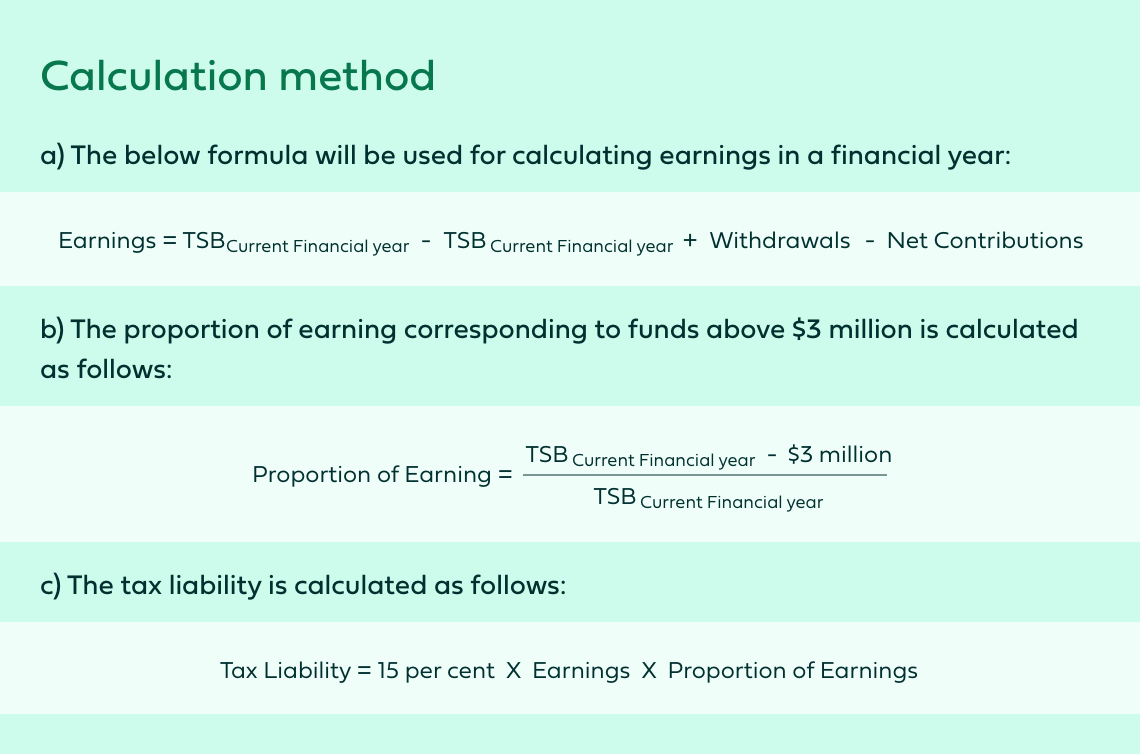

What Is the Proposed Calculation Method?

The government has outlined the following calculation method to determine whether TSBs are liable for the additional tax of 15% on earnings.

You can read more about this calculation method, as well as several general scenarios that may apply, in the government’s factsheet.

Are There Any Exceptions?

Essentially, any individual with a TSB of $3 million or more across an income year will be liable to cough up the additional tax. However, there are a few exceptions (spoiler alert: don’t get too excited):

- Child recipients of superannuation income streams at the end of a financial year.

- Individuals who have a structured settlement contribution made in respect to them as a payment for a personal injury at the conclusion of a financial year, or any year prior.

- Individuals who are deceased before the last day of the financial year.

How Would the Extra Tax Be Paid?

Relevant individuals would have the option of either paying the tax out-of-pocket or from their super funds.

Those with multiple super funds could nominate the fund from which the tax is to be paid.

When Would Tax Liabilities Be Issued?

We mentioned that the proposal is pushing for the changes to come into effect on July 1, 2025.

This means that if the legislation is passed, TSBs exceeding $3 million would be tested for the first time on June 30, 2026 — so the first notices of a tax liability would not be issued to those applicable until the 2026-27 financial year.

Affected individuals would be notified of their tax liability by the Australian Taxation Office (ATO).

How Do I Check My Current TSB?

Individuals can view their TSBs via ATO online services.

Looking for More Support?

There is a lot to wrap your head around with this proposed legislation—but fortunately there is expert assistance on hand to walk you through it.

And whether you think these changes might impact you or not, the team at PrimeAdvisory is ready to help you with your superannuation and tax-planning strategies.

It’s expert financial advice without the jargon.

Email [email protected] to chat today, so we can start planning for tomorrow.

Because possible starts here.